Update 12/18/25: Mesa has updated its website with answers to frequently asked questions about the account closures. Most important for many cardholders is that outstanding points will be converted to statement credits for those who did not transfer points out before the system stopped allowing transfers:

What about outstanding active points balances?To ensure all cardholders receive the full value for their accrued rewards, we will be applying all remaining eligible rewards points as a statement credit that will automatically be applied to your account.

1. No Action Required: You do not need to log in to the rewards dashboard or contact us to redeem your rewards.

2. The value of your rewards will appear as a credit of $0.006 per point on your billing statement.

3. We expect this credit to appear within 7-10 business days. All cardholder and member benefits associated with the Mesa program have been cancelled.

Sadly, that will be at a value of 0.6c per point, which is a terrible value. That said, 0.6c per point is better than 0c per point. There’s no word about pending points for those who were due points for purchases/intro bonuses, which is a shame. This has certainly been unexpected and disappointing in terms of the lack of notice and inability for cardholders to transfer points to partners. Hopefully, Mesa will award points that were pending prior to the shutdown and at least redeem them at the same 0.6c per point, but that may be wishful thinking.

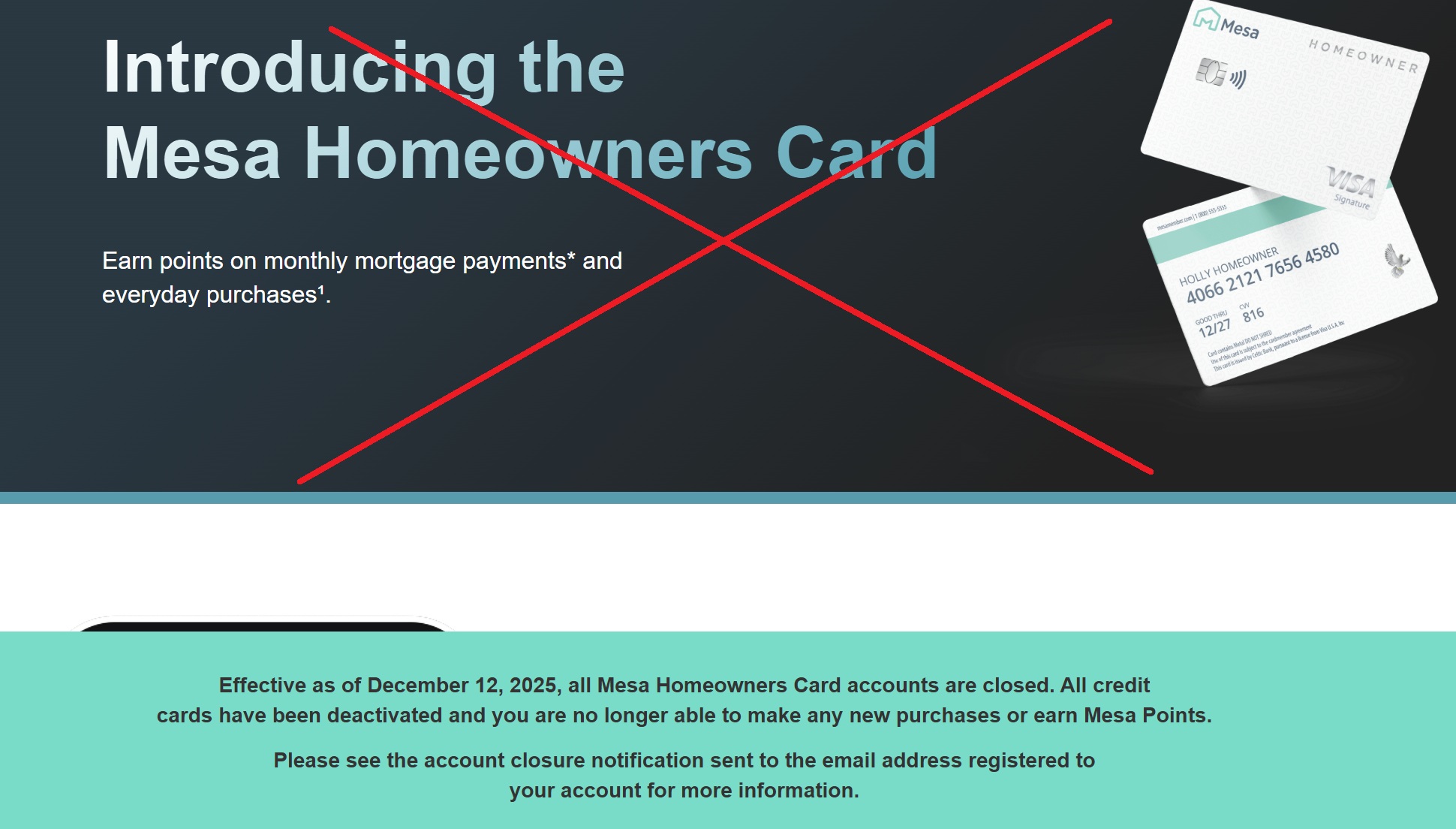

In a really unfortunate development, Mesa Homeowners Rewards credit card customers are receiving an email stating that their cards are being closed, effectively immediately. A message on the Mesa website indicates that all Mesa Homeowners Card accounts are closed. All credit cards have been deactivated as of 12/12/25. This is obviously terrible news and really frustrating for cardholders. At the time of writing, it is still possible to redeem points for a custom statement credit. That’s poor value, but getting poor value now might beat getting no value later if Mesa ultimately goes out of business.

A few days ago, reports started circulating about issues with Mesa card purchases being declined. At least one reader reported that customer service had said that they were experiencing “processing delays” and were working on the issue. Sadly, it seems that they didn’t get the issue solved.

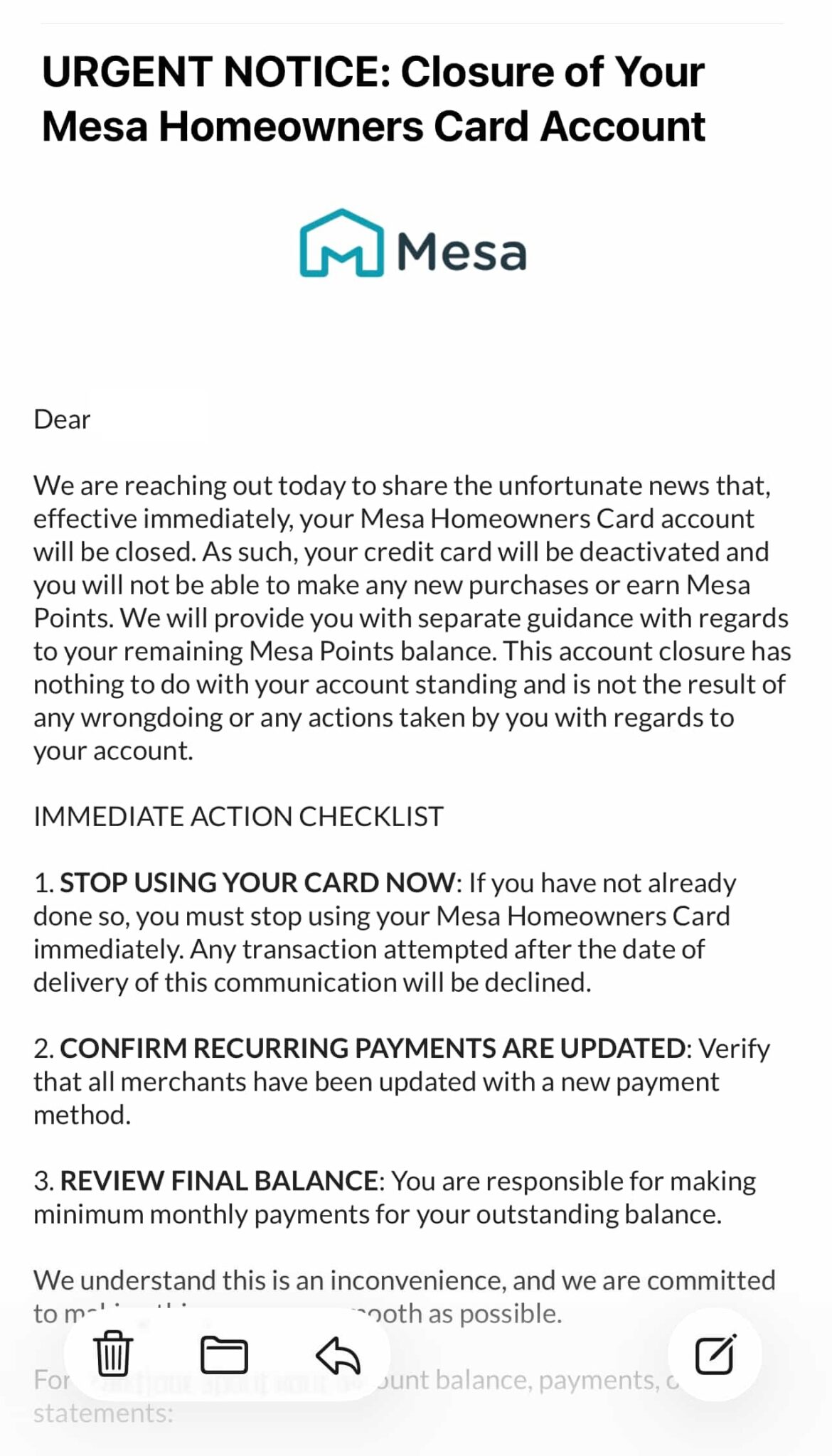

The email going out to cardholders today has the subject line, “URGENT NOTICE: Closure of Your Mesa Homeowners Card Account”. It looks like this.

Unfortunately, the email doesn’t provide any context in terms of the reason for account closure, so many cardholders naturally wondered why their account was shut down or thought it must have been an error.

Unfortunately, the messaging on the website confirms that this is not an error but rather a complete shut down of Mesa card accounts.

We’ve reached out to Mesa for comment and will update if they respond. At this point, it isn’t clear whether this is an issue with the Mesa rewards program/platform or the issuing bank or both.

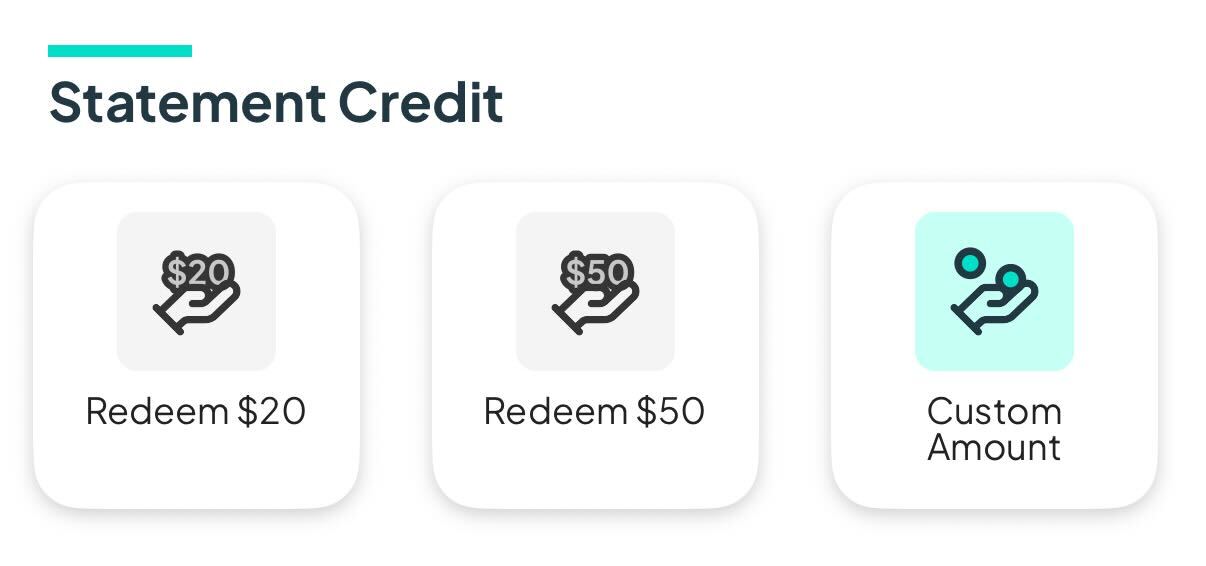

At the time of writing, points can still be redeemed as a custom statement credit (fixed amounts are no longer available). See the screen shot below — the fixed values are greyed out, but custom amounts are still available.

You’ll only get 0.6c per point that way, which is a terrible value. However, if Mesa folds, getting 0.6c now might be better than getting 0.0c later.

To be clear, I don’t know that this is permanent. Maybe Mesa will pick back up, and transfers will become available again. Reports did indicate that Mesa had raised a significant amount of capital just a few months ago. However, given the abrupt nature of all account closures here, my first impression is that this doesn’t bode well. If I had Mesa points, I’d take the 0.6c right now.

Pending points for my December mortgage payment were clawed back from my account (they previously appeared with a future date of 12/25). But I did receive the other pending points from purchases as a statement credit on 12/22, so better than nothing.

My points got credited. On the Mesa app, I’m showing a negative balance. Now I wonder when (or if) I’ll be able to transfer the credit to my linked bank account… Not holding my breath.

Hopefully, you’ll get a refund. According to the FAQs:

The fact that they are at least giving everyone a $0.006/point credit (as opposed to saying “tough luck, your points are worthless) I think bodes positively for the people who used workarounds to do last-minute transfers.

Originally, I was of the mind that most of these transfers would get clawed back. I thought Mesa was essentially bankrupt, had no $ to pay for statement credits OR to buy partner points (which general articles over the last few years have speculated that credit cards might be buying from airlines at rates of roughly 1cpp), and so all of the transfers would be voided. Now, if they can afford $0.006 statement credits, I imagine it’s likely they’ll probably let the last-minute transfers slide.

Stinks, but I look at it as >1.8% cash back card…3 points per dollar @ .06 CPP + free mortgage points. Thats my copium.

Yeah. With my mortgage, and the fact that I was meeting the ~$1000/month requirement via utilities or taxes (which got 3cpp), this was effectively a 10x points card for me (on $1000 of monthly spend).

In the end, those 10x points effectively became 6% cashback. Which is still not terrible, though obviously worth much less than 10x points.

“That’s poor value, but getting poor value now might beat getting no value later if Mesa ultimately goes out of business.”

Nick, what exactly do you think happened that Mesa shut down all of their revolving credit lines if not for going out of business.

Great reporting from Nick as always.

Thomas, that was totally nasty and uncalled for. Really hope you take your comments and business somewhere else.

Take my business somewhere else? What business? This is a public forum and website and I’m sure the FM team appreciates the engagement. I just wish Nick could do a better job thinking his articles through.

If you want a good read, go read a delta flash sale post written by him – says the same thing 20 times.

To answer your question, Celtic Bank (the bank that issued the card) faces significant legal troubles: https://www.bankingdive.com/news/celtic-bank-lawsuit-water-station-ponzi-scheme-sba-loans/758879/

Without having any official communication at the time this post was written, it wasn’t clear whether shutting down the cards was a function of the bank being unable to continue business or the rewards program being unable to continue business or both. Many rewards programs exist independently of their credit cards (including all of the airline and hotel loyalty programs). For instance, if the issuer of Rakuten credit cards closed all Rakuten credit cards tomorrow, you wouldn’t necessarily assume that Rakuten went out of business, would you? I wouldn’t. Without having the full story, I was saying that it was unclear whether this was just the credit cards shutting down (perhaps because the bank is in trouble and Mesa would ultimately find another issuer) or whether the rewards program was shutting down.

The FAQs that exist now suggest that it is the rewards program shutting down entirely, but that wasn’t clear at the time of writing.

Acquisition… Selling credit portfolio…. Bankruptcy…. Restructuring…. etc.

Don’t go into business Thomas, it’s clearly way beyond your mental capacity.

wow glad I cashed in my 100k points to finnair. Funny thing they never even confirmed my “mortgage” of 8500k/month and gave me 8500 bonus points each month on 1k spend

Same with me, but I transferred to Aeroplan. Was also getting mortgage points without a mortgage.

Any wager on what BILT’s ‘final’ credit will be? I’m hoping more than $0.006 per point. Also, we thinking late February 2026… March.. April…? (Come and get me, Ankur’s goons…)

I mean…all the evidence suggests that Bilt is just fundamentally different from something like Mesa. Even if you’re right that Bilt’s cards aren’t sustainable (and I do not stipulate to that, but I won’t fight the hypo), I think we need to take Kerr at his word when he says that cards don’t make up a lot of Bilt’s portfolio. If that is correct, then the cards going under shouldn’t doom Bilt’s broader business, right? So Bilt seems much more secure in the longer term, b/c it’s a more diversified program.

Less ‘hypo’ and more ‘hype’… you’d have to be willfully ignorant to have witnessed the existing nerfing (capping Rent Day at 1,000 bonus, getting rid of Rent Trivia, as if they couldn’t afford giving 250 points, worth like $2.50, to folks) and to not expect a mega-nurf in February 2026.

VP Kerr (who obviously wants to keep his job, get paid, etc.) and BILT’s PR campaign to claim ‘diversification’ is a ‘nice try’ to deflect away from the ‘elephant in the room,’ which is the losses on paying out 1% points on everyone’s rent without charging any fees (both on AFs for the cards as well as for using their platform as a service.)

Whatever ‘data’ they’re getting is not as valuable as what they’re giving away, which is why a ‘too-big-to-fail’ backer like Wells Fargo was essential (WF reportedly loses up to $10 million a month on the partnership because they aren’t collecting the standard 2-3% interchange fees from landlords on rent.)

Do you really think Cardless can ‘eat the cost’ of even a fraction of that? Even if everyone starts paying $495 annual fees on their 2.0 cards, they’d still lose money. Meanwhile, the new AF’s are literally and figuratively a new ‘tax’ on users, still it’s likely not gonna save it, in the end.

As for Mesa, oh, buddy, nothing is identical, but it’s still a valid concern and comparison. It’s the cautionary tale. Sure, Mesa tried to survive as a standalone credit card product without a big bank backer (and that’s likely one reason they failed). Both have relied on venture capital. If BILT 2.0’s partnership with UWM brings them payments for borrowers, that might be some cash-flow, but it’s not gonna offset costs, especially during a macro economic downturn (bad timing).

I had pending points that posted to my account 2 days after the account closure emails went out. I was able to redeem them for a statement credit without issue.

What a messa

I had no redemption options yesterday, even trying the workaround, but today was able to at least redeem for a statement credit. Better than nothing!

Just called and the customer service rep said they found out today and the team will be working for three more days. When I asked who do we reach out to if we had questions after the three days, there was not an answer…I am just wondering what happens if we are set to receive a transaction refund that has not processed yet but will from a merchant?

The answer is: sorry, I guess you are screwed. It’s not complicated.

As of 3:45PM EST I was only able to use the workaround method to reach the “Points Transfer” page but the continue button does not advance to the next step. I think they have blocked this on their end.

What’s they done, is it even legal?

I know it’s a different product, but transferring my Bilt points out, just in case they’re the next to fall.

Good call.

They’re spending their money ‘wisely’: https://www.latimes.com/entertainment-arts/business/story/2025-12-18/why-fintech-firm-bilt-is-funding-its-own-original-series-roomies

This is flat out theft.